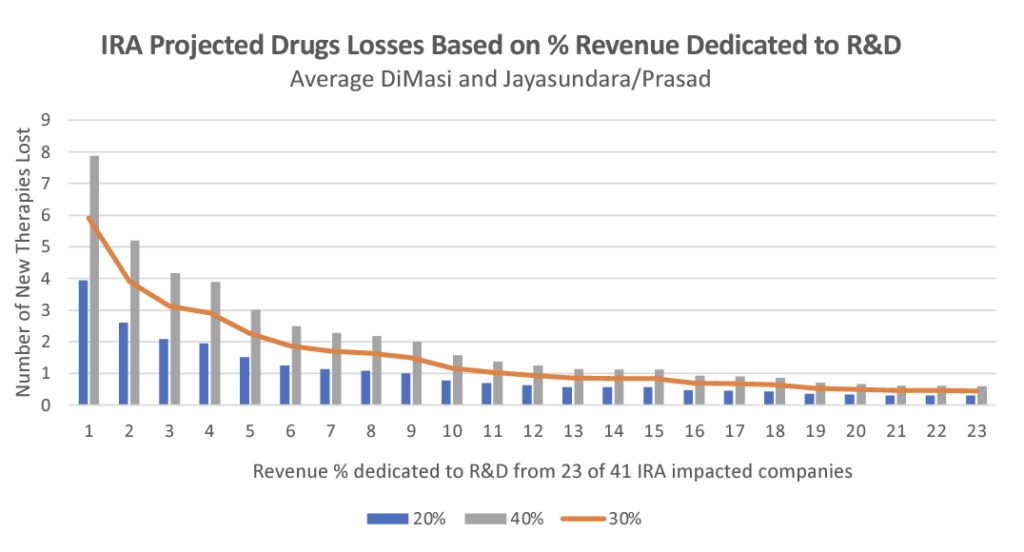

New research released by Vital Transformation (VT) shows that the Inflation Reduction Act (IRA) will stifle the ability of companies to continue research and development across a broad range of therapeutic areas. The effects of the IRA will have a far more serious impact on the development of new medicines than has been reported, according to the research.

Vital Transformation’s data shows that, even when using the most optimistic scenarios under Medicare’s guidance for negotiations, patients will lose access to 40% of medicines that would have otherwise been developed over the next 10 years because of the IRA’s price controls. And this estimate is on the conservative side – it assumes Medicare will set negotiated prices at the IRA’s ceiling price, but Medicare is likely to be more aggressive.

Vital Transformation CEO Duane Schulthess commented: “There appears to be a belief amongst those who have never worked for or invested in the biopharma sector that the IRA’s impact is limited as it “only” targets the top spend drugs each year. However, the IRA’s impact grows over time – cumulatively affecting 100 drugs over the next 10 years. The revenue reductions on these drugs are so large that 37 drugs currently available today would likely have not come to market if the IRA policies had been in place over the past decade. Looking forward, we estimate that, because of the IRA, as many as 139 therapies may not be developed and thus will not get to patients over the next 10 years.”

“We are already seeing companies stop critical research because of the IRA. This analysis shows that these impacts will only grow and become more severe – harming patients desperate for treatments for cancer, orphan diseases, and other areas of unmet patient need,” according to the Biotechnology Innovation Organization’s (BIO) Chief Policy Officer John Murphy.

VT’s analysis also uncovered evidence that the IRA is creating enormous disincentives for those companies trying to bring new treatments to market across a range of therapeutic areas, including orphan drugs and rare cancers.

“Our modeling uncovered that a successful cancer drug company will lose a substantial amount of its future earnings as well as pay a large penalty for focusing on orphan indications. In fact, our assessment indicates that delaying market entry by three years to target a stage two adjuvant cancer treatment improves the return on investment by over half-a billion dollars,” said VT consulting economist Dr. Harry P. Bowen.

The full research pack is available for download at www.vitaltransformation.com.