REPORT HIGHLIGHTS

Employees

Economic Output (Billion)

Average Wage

Industry R&D (Billion)

Facilities

Academic R&D (Billion)

By several metrics, the Illinois life sciences industry is large, growing and recognized as a national leader. More than 41,000 people are employed at life science companies statewide and increases in the number of life sciences workers at Illinois companies from 2014 – 2016 have outperformed national averages.

The Life Science industry is a large contributor to the Illinois economy. The overall economic output of the industry was $98 billion. Economic output represents a broadest measure of economic activity. It represents the sales related to life sciences firms as well as the suppliers and service industry firms that benefit from the spending of life sciences employees.

Regarding wages, the life sciences industry is also one of the highest paying industries. Illinois residents employed by life sciences companies earn 91% more than the average Illinois resident. Illinois state and local taxes paid by the life sciences industry equal approximately 4.7% of all state and local taxes collected in Illinois.

The geographic distribution of the life sciences industry is also diversified, with companies found in counties throughout Illinois.

Lake County, with 18,317 employees, is home to the nation’s second largest pharmaceutical cluster (only New York/New Jersey/

Philadelphia is larger). The “I-294 corridor” of established pharmaceutical and medical device companies (Abbott, AbbVie, , Baxter, Fresenius Kabi, Horizon Pharma, Lundbeck, Pfizer, and Takeda) comprises the majority of the employees in the Illinois life sciences industry. Lake County is also home to a number of growth- stage biopharma companies, including Assertio, Athenex, and TerSera.

Cook County includes Chicago and is home to three major research universities: Northwestern, University of Chicago and University of Illinois at Chicago. Because of the proximity to these research institutions and incubators, the majority of the startup community in Illinois is located in Cook County. The North American headquarters of pharmaceutical company Astellas and many life sciences service organizations also are located in Cook County.

Macon county is home to large food processing segments of the community, including Archer Daniels Midland and Tate & Lyle. With 5,114 employees, Decatur has the highest concentration of agricultural employment in the United States.

Kankakee County is home to CSL Behring’s manufacturing site in Bradley. This site currently employees over 1,400 employees, and the company recently announced a 1.8 million sqf expansion.

Champaign County is home to the University of Illinois at Urbana-Champaign and its Enterprise Works, a 43,000 sqf incubator that was named one of Inc. Magazine‘s “Top 3 College Town Incubators” and one of Forbes‘ “12 Business Incubators Changing the World.”

INVESTMENT

Illinois life sciences companies have received $1.6 billion in venture capital investments from 2014 through 2017. Illinois also boasts state programs to increase access to startup capital like the Illinois Angel Tax Credit Program.

Looking at the sub sectors, the majority of the VC investment was for health technology and for pharmaceutical development. Medical device venture capital investment in medtech has declined over the past several years. As a result many startup medical device companies are struggling to make it out of the “valley of death”. While large medtech companies depend on a thriving external innovation ecosystem for acquisition targets and new sources of growth, many shy away from investing in early-stage, unproven technologies.

Recent reports shows encouraging signs of a reversal of this long-standing trend. Total venture investment in medtech increased nearly 60 percent from $5.8 billion to $9.0 billion nation wide (Global Data, “Medical Intelligence Deals Database,”). The nature of early-stage deals suggests this reversal might be driven in-part by interest in digitally-enabled devices, as investors are interested in digitally-enabled diagnostics.

Ag and especially “ag-tech” funding continues to trend upward. The last 10 years have seen remarkable growth in agtech investment nationwide, with $6.7 billion invested in the last 5 years and $1.9 billion in the last year alone, as shifting consumer preferences drove a funding surge in burgeoning investments areas such as alternative proteins (Finistere Ventures 2018 Agtech Investment Review).

RESEARCH & DEVELOPMENT

Among all US industries, life sciences has the highest percentage of research and development (R&D) investment of any US industry. According to publicly available reports, Illinois-based life science companies spent over $14 billion in R&D last year. The pharmaceutical industry was the largest contributor at more than $10 billion, with medical device companies reporting just over $3 billion in R&D expenditures. The agricultural industry is not as research intensive as pharmaceuticals and medical devices, but major food processing companies in Illinois reported just over $218 million in R&D last year.

Illinois is home to 11 research universities with spending of more than $1.4 billion in R&D last year. Illinois universities have steadily increased their R&D expenditures. R&D at Illinois academic research centers has increased by $33 million since 2014. National Institutes of Health (NIH) funding directly impacts trends in bioscience-related academic research. For several years iBIO and other groups and associations have raised concerns about declining NIH research budgets and the corresponding effect on academic research. Fortunately, NIH funding is on the rise. Budget increases have been sustained each of the last three years, with FY 2016 – 2018 R&D budgets increasing an average of 4.8% annually. This increase has translated into a growing funding base for research awards in Illinois. This expansion in R&D at Illinois universities can be attributed in part to their success in obtaining federal funding.

COMMITMENT TO PATIENTS

Illinois life sciences companies are committed to expanding the boundaries of science by discovering, developing, and delivering innovative and needed medications to patients.

To that point last year, Illinois-based biopharma companies helped over 400,000 patients receive the medications they need through the companies’ financial assistance programs and participation in the Partnership for Prescription Assistance (PPA). Founded in 2005, the PPA helps people connect to patient assistance programs (PAPs), which serve as critical safety nets for the millions of Americans who lack health insurance or whose insurance does not sufficiently cover the cost of the medicines they need.

Also last year, industry sponsored over 1,200 clinical trials in Illinois, with an estimated enrollment of over 20,000 Illinois residents at clinical sites located throughout the state.

In Illinois, pharmaceutical companies benefit from conducting their trials at the states’ highly respected university medical schools, comprehensive cancer centers and clinical trial research centers. Illinois is home to a number of the nation’s top research-oriented medical schools, University of Chicago’s Pritzker School of Medicine, Northwestern University’s Feinberg School of Medicine, the University of Illinois College of Medicine, Rush University College of Medicine and the Stritch School of Medicine at Loyola University ranked.

The Battelle Technology Partnership Practice estimates the industry’s 2018 investment in clinical trials in Illinois was nearly $250 million.

MEETING THE FUTURE NEEDS OF A CHANGING COMMUNITY

Growth in the Illinois life sciences industry traditionally has been a result of the expansion or relocation of large corporate headquarters. For the past two years Site Selection Magazine has named Chicago as the top location among all large US metropolitan areas for corporate facility investment projects.

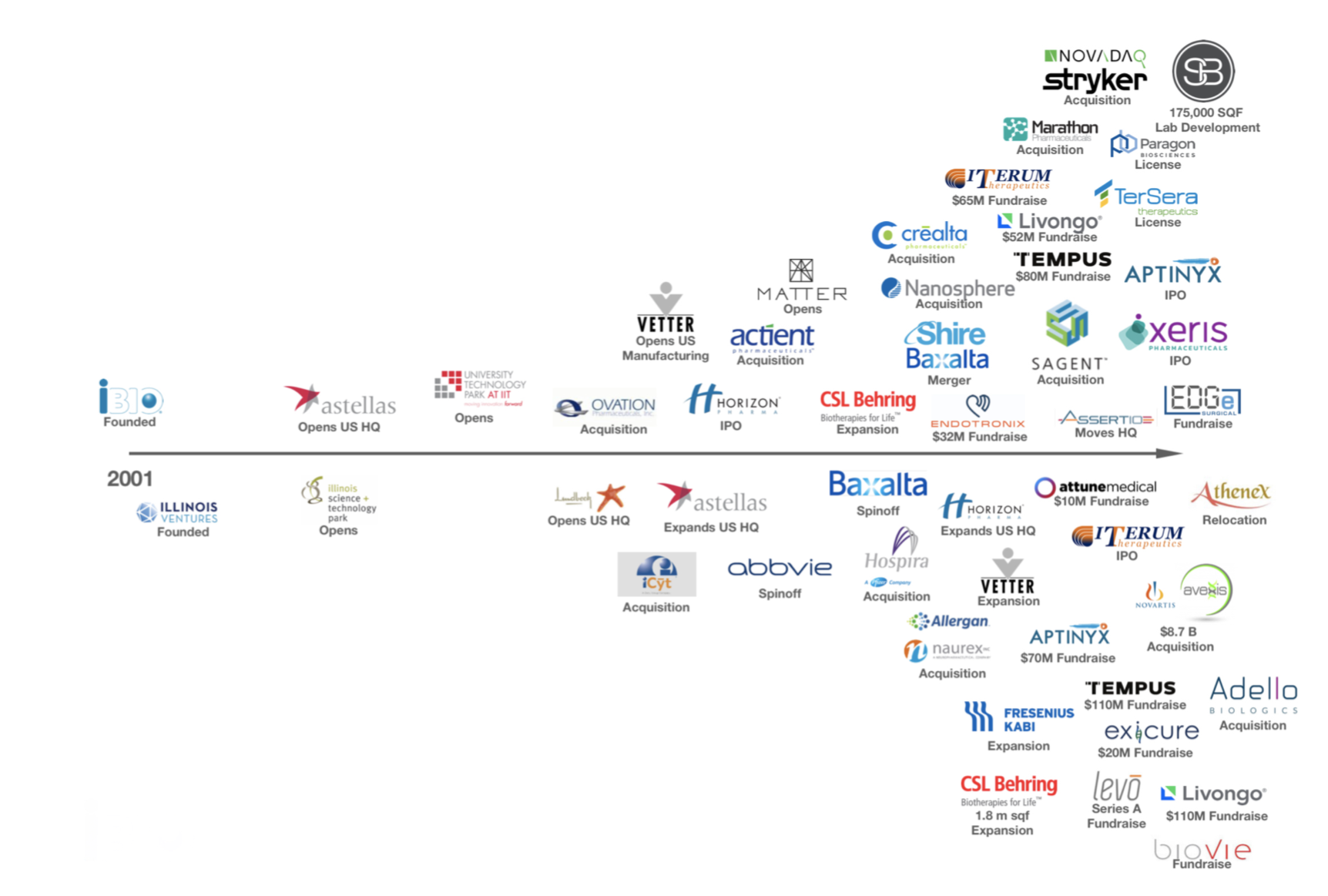

Early in the 2000’s Chicago attracted a number of corporate expansions and relocations, including Astellas, Takeda, Lundbeck and Vetter Pharma. Recent state and local efforts have focused on attracting these large corporate investments into Illinois.

But over the past couple of years we have started to see a dramatic shift in the makeup of the life sciences community in Illinois and across the US. This change is partially driven by mergers and acquisitions and also by the growing importance and number of R&D stage companies. The graph below provides an illustration of the momentum in the Illinois life sciences industry.