CBRE, the global real estate services firm, recently released its annual U.S. Life Sciences Talent & Scientific Workplace Update, which sheds light on the current state of the life sciences industry in the United States. According to the report, the number of U.S. life sciences research professionals has grown by 3.1% in the past year, reaching a record high of 545,000 individuals.

One notable trend is that life sciences researchers tend to be younger, more diverse, and have higher salaries and wage growth compared with the overall U.S. workforce. Between 2018 and 2021, the average salary for U.S. life sciences researchers increased by 14.5%, with a projected increase continuing through 2023. Additionally, the labor market remains extremely tight, with the number of U.S. life sciences researchers not declining in more than 20 years through three recessions.

Chicago stands out in the report with a 113% increase in lab inventory since 2018, ranking first in percentage increase among top markets. This highlights Chicago’s growing importance as a hub for the life sciences industry, which is becoming increasingly important for the future of healthcare. Furthermore, with the trend of life sciences researchers being younger and more diverse, the growth of lab inventory in the city will also be an essential resource for companies looking to attract young talent, positioning Chicago as a critical location for corporate expansion and relocation.

The report also found that the number of college graduates earning biological and biomedical sciences degrees increased by 4.8% year-over-year in 2021 to 171,520, indicating a growing interest in pursuing careers in the life sciences.

State Based Incentives Critical to Continued Industry Growth

To continue to grow the industry in Chicago and Illinois, the state has to improve its economic toolkit to attract companies and help them growth. A separate CBRE report release earlier this year, CBRE’s 2023 US LIfe Sciences Outlook report (released earlier this year) highlighted as life sciences companies increase spending on R&D facilities, many are seeking ways to offset ongoing operating expenses and one-time capital investments.

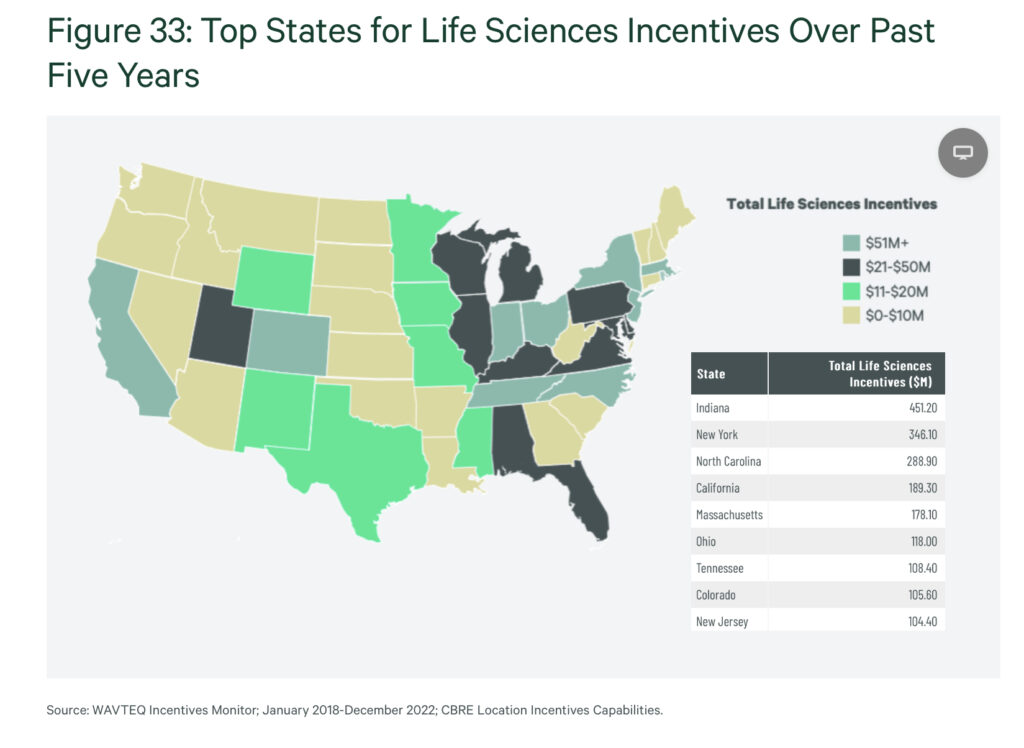

Life sciences incentive programs have been particularly strong in three states over the past five years (Indiana, New York and North Carolina), which combined totaled $1.1 billion or almost 45% of total U.S. life sciences incentive programs. Since 2018, there have been 1,113 public life sciences incentive deals in the U.S. totaling nearly $2.5 billion for an average of $19,146 per new job or 6% of a recipient company’s total capital investment. Companies are leveraging these incentive savings to underwrite costs for real estate portfolio growth.

Last week BIO and the CSBA release the report “The U.S. Biosciences Industry in the States: Best Practices in Innovation, Partnerships, and Job Creation.” The report “analyzes the latest legislative and regulatory economic development initiatives at the state and regional level that help support the bioscience sector.”

Here are four major highlights form the report:

- Building career pathways for future biosciences talent is crucial. “Attracting and retaining a continuing flow of educated (Ph.D., MS, BS, AA) and technically-proficient workers is essential to a state aspiring to enhance a biosciences industry presence,” says the report.

- States and regions are committed to biotech industry stability. “A stable and supportive public policy framework is vital to industry firms, large and small,” says the report. “It is impracticable, and ill-advised, for any state, city or municipality to miss the value of selective incentives to either hold existing Biosciences companies or attract new enterprises.”

- Innovative tax support strategies are on the rise. Both the private and the public sphere are finding new ways to expand the playing field for biotech startups with early-stage capital. This is especially important as the vast majority of the biotech industry is composed of small and early-stage biotech companies. “Supportive measures include investor tax credits to spur more early-stage investment in Biosciences companies, and seed funds to bridge the funding gap for companies as they develop and advance their technologies, conduct initial research, and establish proof of concept before attracting larger investments,” says the report.

- Universities and research centers continue to be strong partners. “Thanks to a coalition of industry and university technology transfer groups across the nation that have provided strong support for enhanced federal legislation, including the Bayh-Dole Act of 1980, U.S. colleges and universities continue to be the international leaders in generating cutting-edge basic research and creating companies from that research effort,” says the report. “States have made company formation a high priority, especially policies that encourage full funding of basic research, predictability of patents, and flexible technology transfer, and that provide early-stage funding opportunities and incentives that will serve to stimulate biotechnology innovation.”

“BIO and CSBA’s new report serves as a roadmap for economic development in the biosciences industry, showcasing proven strategies and innovative practices implemented by states across the U.S.,” says John Conrad, Board Vice Chair of CSBA and President and CEO of Illinois Biotechnology Innovation Organization (iBIO). “Illinois, in particular, has made significant strides in implementing economic incentives to drive growth in the state’s bioscience sector, generating high-quality jobs, and fostering an entrepreneurial ecosystem that remains essential to the industry’s future success.”